The Best Paystub Generator

- Home

- Blog

- Paystub Generator

- The Best Paystub Generator

Pay stub generators have become essential in every company, making people want to use paycheck stubs more and more over time. Old paper methods quickly become messy and unusable, so this article teaches you how to create a pay stub online, information about Net pay, fake pay stubs, and more!

Best Paid Pay Stub Generator Websites

There are plenty of pay stub generators online, some with more features than others. Some are free, and others are paid. Here are some of the best-paid websites made for creating pay stubs:

1. Real Check Stubs

Real check stubs is the best authentic site for creating paystubs! We offer real trusted pay stubs that are instantly generated, 24/7 customer service, and are ideal for record-keeping. Real check stubs is extremely simple to use as it takes less than a minute for you to generate high-quality pay stubs! Making it very efficient, and great for all-purpose use.

Why Real Check Stubs is the best pay stub generator

Real Check Stubs created the online paystub generator after we noticed a gap in how new entrepreneurs and freelancers documented their pay. We created an easy-to-use platform that makes it extremely simple to generate pay stubs.

On the front end of the pay stub generator, the user enters the basic information. On the back end, the Real Check Stubs system handles all of the calculations.

How to use the pay stubs generator

- Enter information such as company name, your work schedule, and salary details

- Choose your preferred theme and preview your pay stub

- Download and print your pay stub instantly

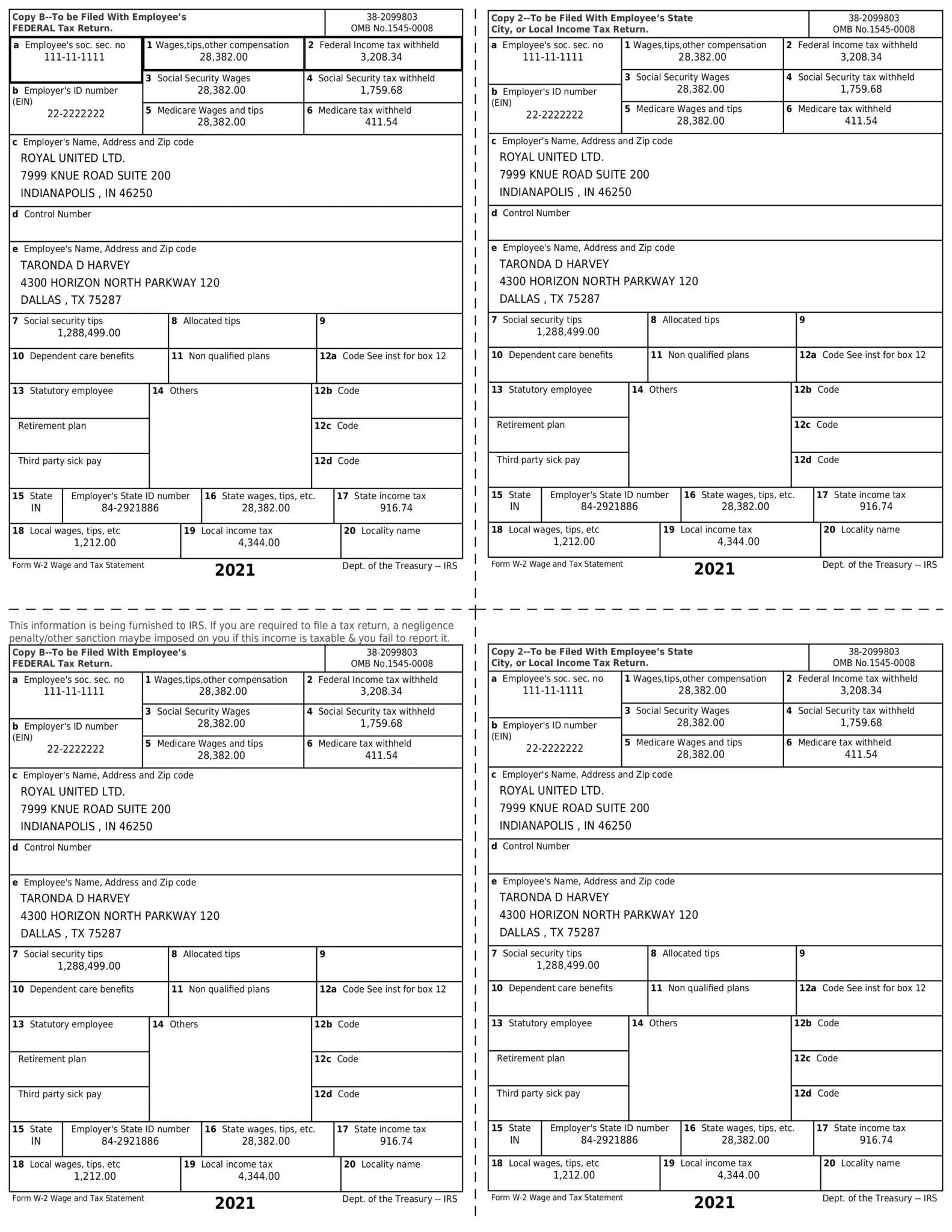

W-2

A W-2 tax form shows important information about the income you've earned from your employer, the amount of taxes withheld from your pay stub, benefits provided, and other information for the year. You use this form to file your federal and state taxes.

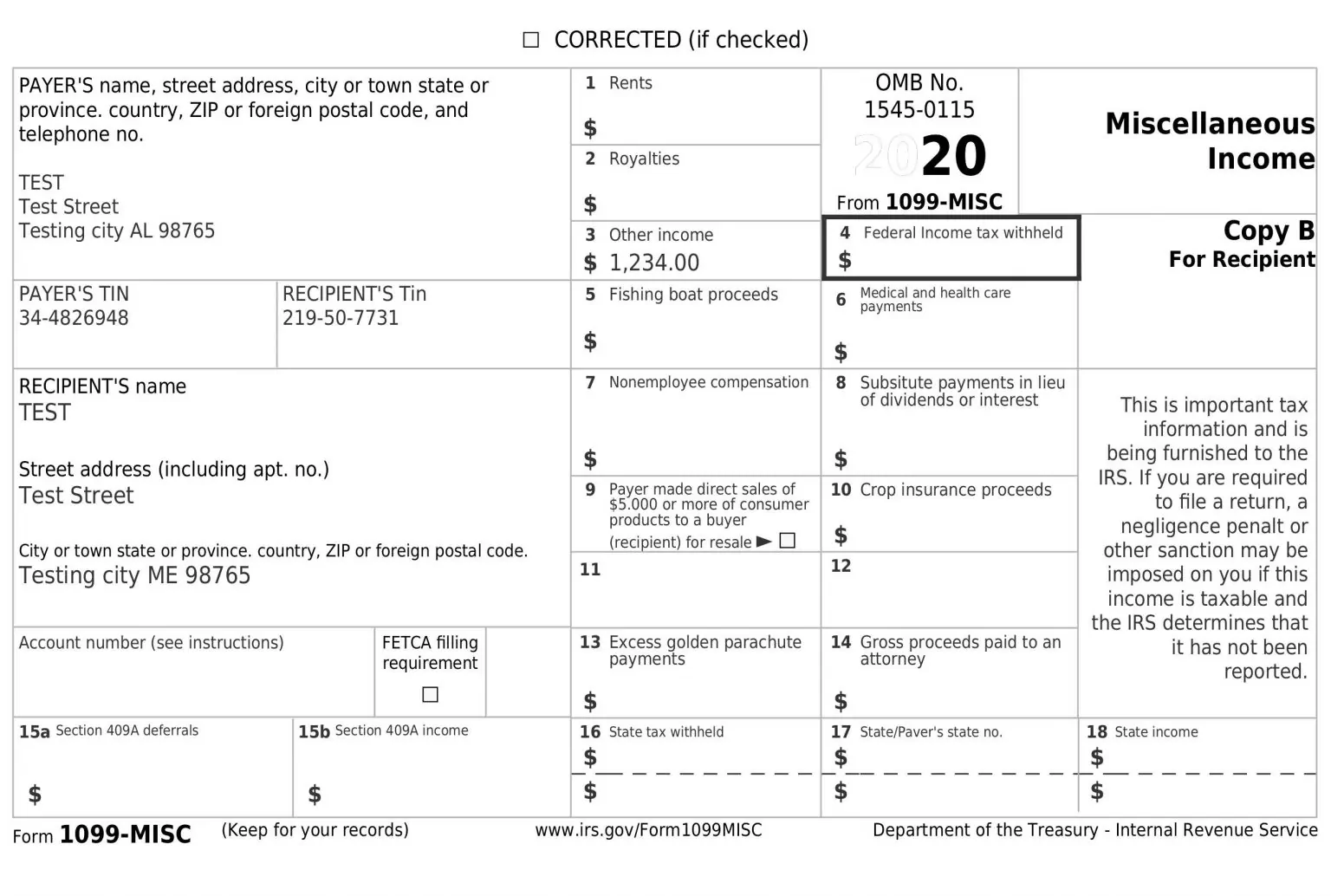

1099 Form

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. The payer fills out the form with the relevant details and sends copies to you and the IRS, reporting payments made during the tax year.

Gross Wages

The gross wages of your employee (sometimes referred to as gross income) are their pre-tax wages. This is the amount your employee earned before any state income tax or federal income tax is taken from their pay.

Hourly workers are paid gross wages by multiplying their hourly rates by their work in a given pay period. For example, an employee with a $20 hourly wage who works 80 hours per pay period would have gross wages of $1600 ($20 x80). This calculation should include overtime hours.

You would divide the salary of salaried or exempt employees by the number per year to calculate their gross wages. For example, let's say you have a $52,000 salary employee, and you pay them weekly. Their gross wages would be $1000 ($52,000/52). Pay stubs for gross wages should contain at least the minimum information, though your state may require more.

-

Both the individual pay period earnings and the YTD earnings are gross pay.

-

Hours worked

-

Pay rate: Regular

-

Additional earnings (including overtime payment)

-

Accumulated time off (including vacation and sick time)

Pay Stub Templates

The templates used for pay stubs are very similar. You can also download templates for paystubs and make your own. Here are some details to remember when you create or modify a paystub template. Check out our paystub templates guide.

-

Company name

-

Company address

-

Employee name and address

-

Hourly rate

-

Hours per pay period

-

Deductions

-

Year-to-date pay

-

Social Security

-

Employee ID number

-

Pay date

-

Taxes paid

-

Proof of income

Calculating Net Pay

Calculating net pay is very important. Here is an example of calculated net pay. Averaging $600 per month, Sally has 26 payroll processing sessions each quarter (two days). The salary for Sally is $2308 per month - $260,000 per quarter. Based on the allowances in the W-4, your business should not pay 20% tax.

The total amount for Sally's company-wide health plan is $575. Sally's net earnings were $230, less $577 in taxes, and she earns about $780 per year. This information should also include a list of current and past employees' salaries.

State Requirements For Pay Stubs

Neither the U.S. nor any other country is required to comply with pay stub regulations. Despite these requirements, employers are required to keep employee time and salaries in the records. Your state's PayStub Rules site determines how to apply in the state. Firstly, it's important to confirm that it's an opt-out.

FAQ

Who Needs A Pay Stub Generator?

Making pay stubs is not accessible either at individual or business levels, and employers and businesses can easily prove their income through pay stub generators. A pay stub is especially useful when businesses or workers need it during tax season. Here is a list of the beneficiaries on the pay slip document.

Do I Need A Paystub Generator?

To determine how much standardization is essential for any business, assess the situation and consider these options.

Staff shortages

In small businesses, the majority of people depend primarily upon the HR team for their operations. Is the job available for emigrant workers? Eventually, it can cause chaos and your staff to burn down. All of this makes for a compelling business to consider creating pay stubs in an efficient, streamlined way.

Disorganized payroll system

If you are using paper payroll for payroll purposes, then you should reconsider this practice. The paper could be stolen, exploded in flames, and even discarded by accident. The paper records we have today make us uncomfortable and create unneeded work. That is why it's better to create a paycheck stub with employee information and the employee's salary.

Unsatisfied employees

Do employee pay stubs feel cheated over or miscalculated? If so, then it'll cause more dilemmas for the company because of not using a pay stub generator.

Do I need to show proof of income to create check stubs?

it is mandatory to prove income when using online check stub maker sites, so the paycheck stubs created will need proof of income. Some pay stub generators may not have that included in them, which might allude to that generator possibly being fake.

Are pay stubs necessary?

Pay stubs have been a subject of debate about whether they are legal or not, but there is no federal law that requires employers to provide employees with pay stubs. In legislation, pay stub law falls under the Fair Labor Standards Act (FLSA). Beyond that, employers are subject to state legislation and compliance.

How to spot a fake pay stub?

Fake pay stubs tend to have a lot of evidence to check whether a pay stub is real or fake. Some of it can have Os instead of zeros, some can have spelling errors, some can have rounded numbers, and some can have missing and incorrect information.

Who needs Pay Stub Generators?

Making pay stubs is not easy at individual or business levels, and employers and businesses can easily prove their income through pay stub generators. Pay stubs are especially useful when businesses or workers need them during tax season. Here is a list of the beneficiaries on the pay slip document.

The information posted to a Pay Stub

While states may need different pay stub forms generally contain such information:

Income Tax Deductions

The worker determines the tax withholding amounts on their wages on Form W-4. All states are required to file withholding forms on the income tax withholding form. It collects taxes on Social Security and Medicare. In 2020, Social Security employees' taxes were 6% on earnings up to $137.000, and Medicare taxes are a 1% payroll tax for most workers.

High-income citizens are also subject to a 0.9% tax on Medicare. The employee FICA tax will be 76% from 2019 to 2021. The employer pays 7.65% of costs and is deducted from its business expenses, and employers pay primarily through a payroll stub.

(social security workers are being taxed or is it social security being taxed from workers, explain more)

Hours Worked, Pay Rate

This is particularly significant with non-excluding (hourly) work. Usually, the pay stub must contain 40 days of overtime time. The pay stub should include the total time spent on the job and the hourly wage. Some workers are required by a union contract to receive a certain wage if work hours are longer than normal. Salary workers are sometimes required to list their hours in paychecks.

Benefit Deductions

Workers usually have insurance coverage for companies and may be included in a retirement plan like a 401k. 401k contributions are deductible and employers may also make matching payments for their contributions.

Unemployment Taxes

Unemployment is financed through Federal & State FUTA taxes. The amount is remitted through the employer as part of a stub.

Conclusion

In conclusion, online pay stubs are necessary for modern-day companies, so every company should provide pay stubs to its employees. There are many pay stub generators out there. To help with that, we have compiled the best paystub generators for your use! Whether it's a small business or a company, it's always a good thing to use pay stubs.

Kristen Larson is a payroll specialist with over 10 years of experience in the field. She received her Bachelor's degree in Business Administration from the University of Minnesota. Kristen has dedicated her career to helping organizations effectively manage their payroll processes with Real Check Stubs.