Kristen Larson - Blog Author

Kristen Larson

Kristen Larson is a payroll specialist with over 10 years of experience in the field. She received her Bachelor's degree in Business Administration from the University of Minnesota. Kristen has dedicated her career to helping organizations effectively manage their payroll processes with Real Check Stubs.

December 16, 2023

How to make a Paycheck Stub

Learn quick and easy steps to make a paycheck stub with our guide. Create an error-free stub in minutes and ensure your financial records are accurate.

January 25, 2023

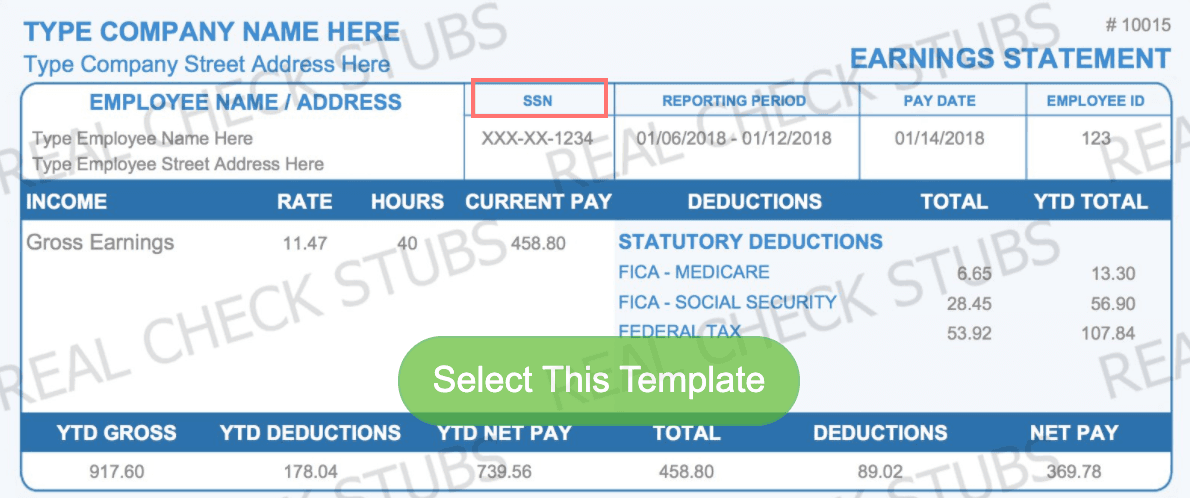

High Quality Professional Paycheck Stub Maker

Here's your chance to review the various paystub templates our pacyheck stub generator makes. Discover why we are known as the go to place for real paystubs.

January 25, 2023

Customizable Options

Do you want to customize your paycheck stub? Then, explore 16 different templates of Real Check Stubs and make your stub unique by one of them.

January 25, 2023

Why you should customize your paycheck stubs

Your paycheck stubs should be unique. Discover 16 different templates of Real Check Stubs and customize your stub by one of them.

December 16, 2023

Employee Pay Stub - Online Salary Slip Maker

Easily create professional employee pay stubs with our online salary slip maker. Streamline your payroll process and save time and money.

January 31, 2023

Self-Employed Pay Stub as a Freelance Proof of Income

As a freelancer, it can be challenging to prove your income when request a loan from a bank. Find out how self-employed pay stubs can be used as proof of income

January 26, 2023

Pay Stub Abbreviations and Acronyms Decoding Tips

Learn some of the most used abbreviations and acronyms used on paystubs. Discover header, earning and tax-deductions abbreviations!

March 1, 2024

Pay Stub with Voided Check - What You Need To Know

Voided checks can not be filled in, cashed, or deposited. Here is everything you need to know about pay stubs with voided checks.

July 8, 2023

Check Stubs For Renting Apartments – Why Is It Important

Discover why check stubs are important for renting apartments. Learn what information to include and how to properly present your income.

July 9, 2023

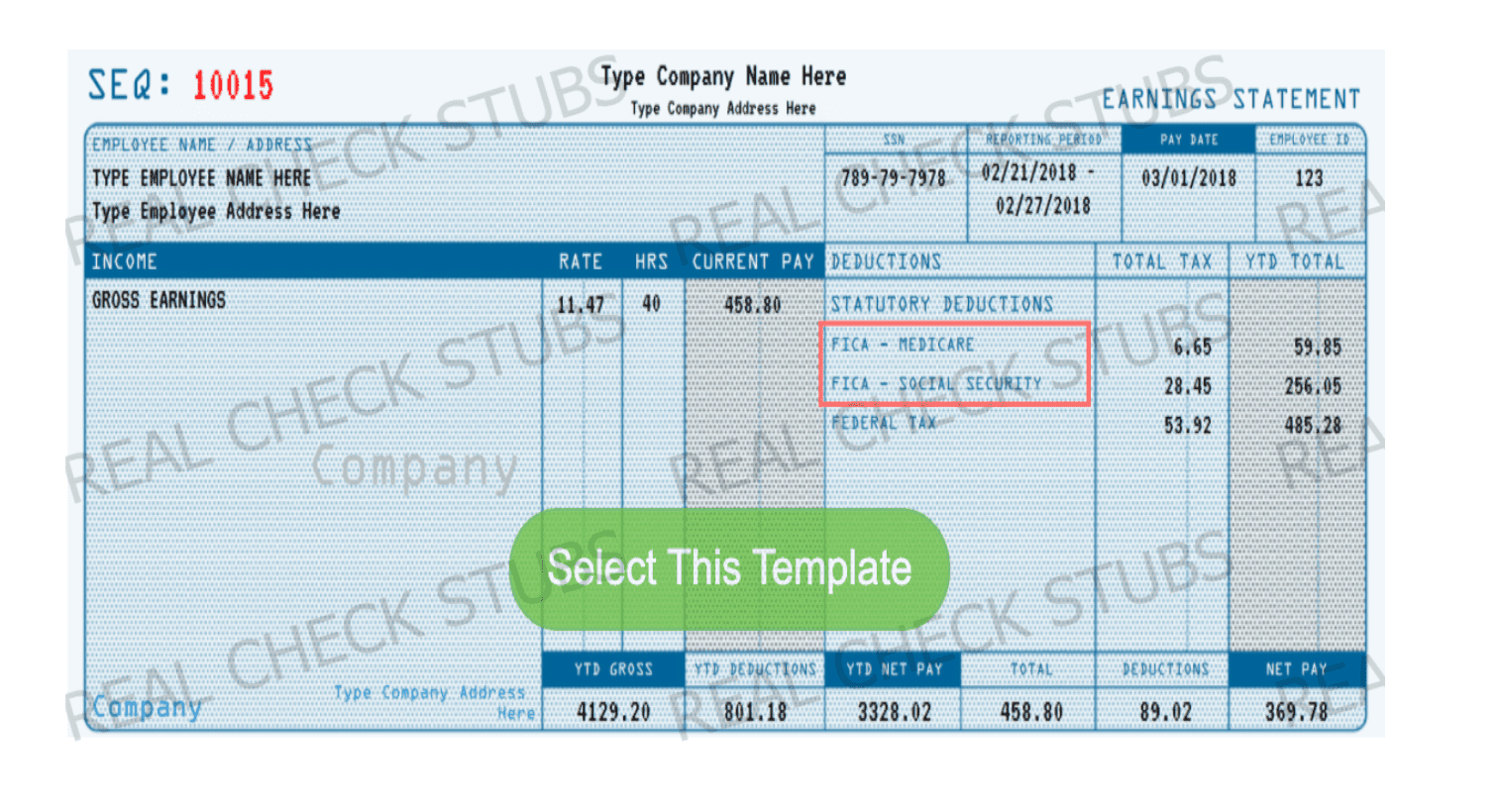

What Is FICA On My Paystub?

Confused about FICA on your paystub? Learn what the FICA tax rate is, how it is calculated, and how it affects your income with the latest changes.

July 9, 2023

Gross Pay vs Net Pay On A Pay Stub - What's The Difference?

The good news is you don't need to be an accountant to know the ins and outs of gross pay and net pay. Read along as we detail all you need to know about them.

July 9, 2023

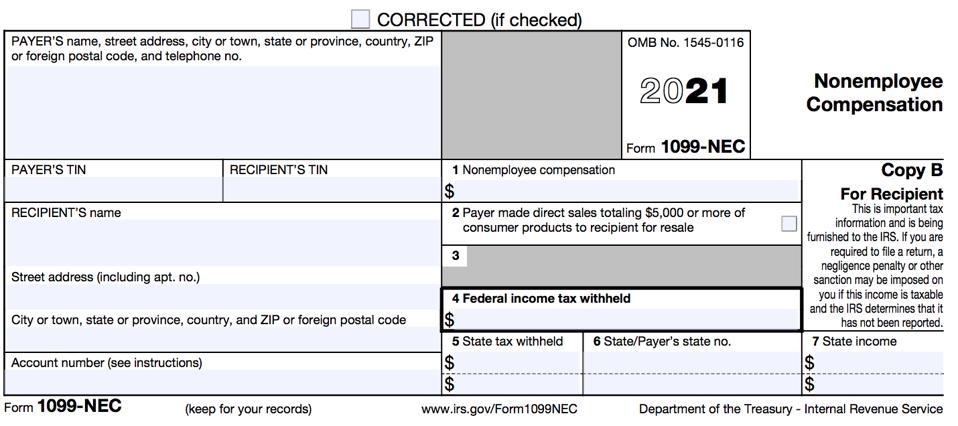

What is Form 1099-NEC and Who Needs to File?

The nonemployee compensation 1099 form or 1099-NEC allows employers to report payments amounting to $600 or more to nonemployees. Who needs to file?

December 13, 2023

Top 13 Small Business Accounting Advice To Save Your Money

As a business owner, consider and review each small business accounting advice and implement them for a successful and growing business.

June 20, 2023

How Can I Get a Copy of My W2 If I Lost It?

A lost W-2 could cause trouble when filing tax returns, so knowing how to get a replacement W-2 statement would help you through such times.

July 9, 2023

S Corp vs C Corp - Detailed Comparison

Deciding between an S corp vs. a C corp could become tricky without first familiarizing yourself with their relative advantages and disadvantages.

.png&w=1920&q=75)

July 9, 2023

Pros and Cons of a Limited Liability Company (LLC)

Before deciding to form a Limited Liability Company, business owners need to consider and review all benefits and drawbacks of an LLC carefully.

July 9, 2023

What is LTD (Long-Term Disability) on my Paystub?

Knowing what is LTD on a paystub would go a long way if you have a chronic illness or an injury that would stop you from fulfilling your work.

July 9, 2023

W-2 vs. W-4: What's the Difference and How to File?

Explore basic the differences between IRS forms W-2 and W-4, which are used to record employee wages and taxes withheld by employers.

July 9, 2023

How to Calculate AGI (Adjusted Gross Income) from W-2

As a taxpayer, you should know how to calculate AGI from W-2 forms or paystubs to make taxpaying as easy and as fulfilling as possible.

March 1, 2024

What Is FUTA: Overview of FUTA Tax Rates, Calculations, Credits

As a business owner, you need to understand The Federal Unemployment Tax Act Tax Rates, Calculations, and Credits. Discover a detailed overview of FUTA in 2023