Blog

Stay informed with the latest tips, trends, and insights in financial management. Our blog is your go-to resource for everything related to payroll, accounting, and the best practices for using 'Real Check Stubs.'

Our All Post

May 8, 2025

What Happens If You Forgot to File a W2?

Let this guide highlight for you what happens if you indeed forget to file a W2 and how best to remedy the situation.

May 8, 2025

How to Get a Copy of W-2 Fast: 6 Quick Methods

Need your W-2 quickly? Discover 6 proven methods to obtain your W-2 form within days or even minutes, including online tools and official channels.

May 8, 2025

Who is Responsible for Incorrect W2?

What to do if your W-2 form is incorrect, stolen, or you never received it

February 18, 2025

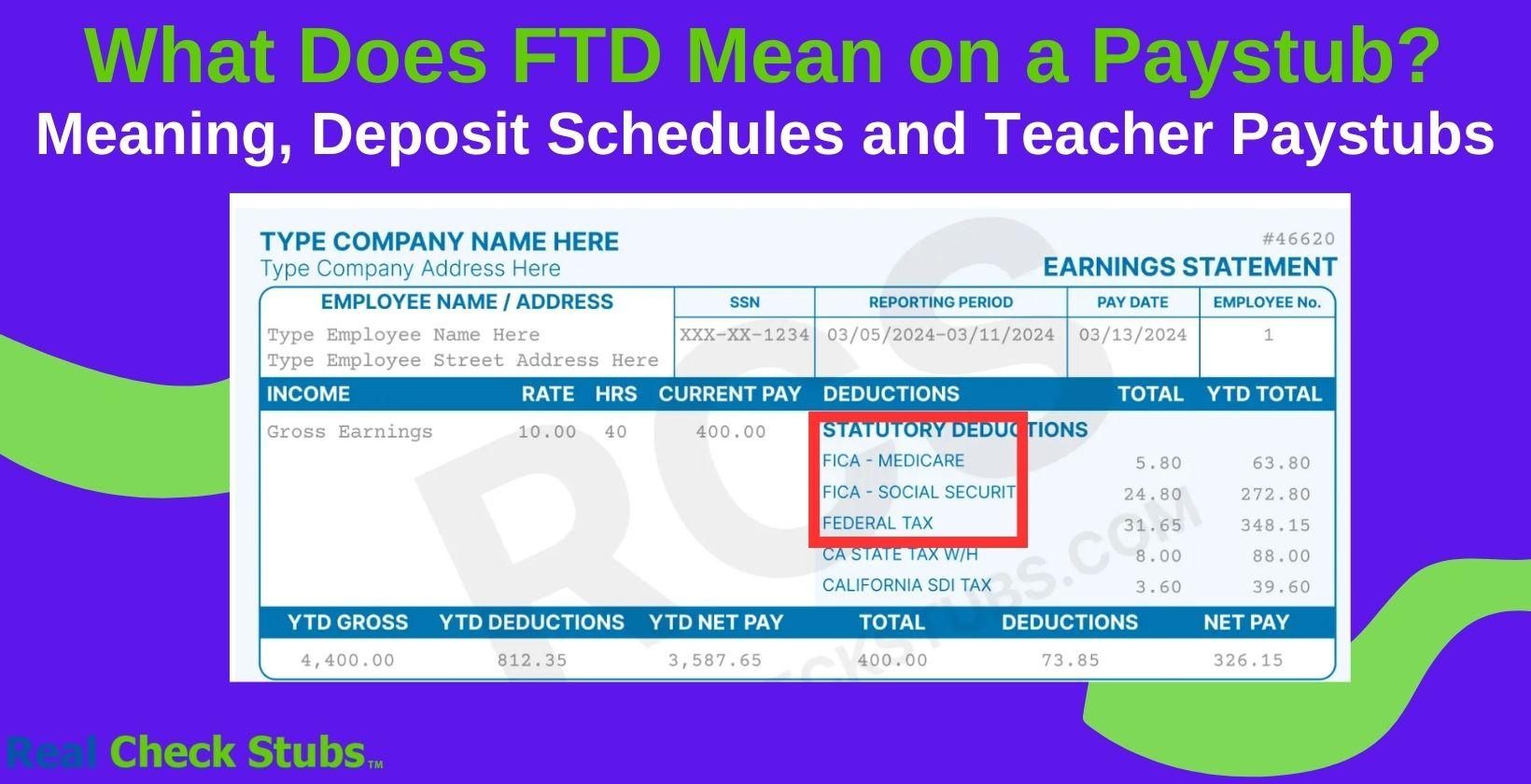

Federal Tax Deposits (FTD) Meaning on Paystubs

Learn about Federal Tax Deposits (FTD) on paystubs, including deposit schedules, IRS compliance, relationship with teacher paystubs and how they impact your payroll taxes and deductions

![2025 Social Security Taxable Maximum: FICA and Payroll Taxes [UPDATED]](/_next/image?url=https%3A%2F%2Fwww.realcheckstubs.com%2Fstorage%2Fposts%2F2025-social-security-taxable-maximum%20.jpg&w=1920&q=75)

February 9, 2025

2025 Social Security Taxable Maximum: FICA and Payroll Taxes [UPDATED]

Learn about the 2025 Social Security taxable maximum, COLA and FICA tax changes, and key payroll updates for employers to stay compliant and manage paystubs

January 13, 2025

What’s California State Disability Insurance – Employee (CASDI-E) on Paystub?

Learn about CASDI-E tax, its benefits, funding, and how it supports California workers through disability insurance and paid family leave programs.

January 6, 2025

What Is KMTCHTR on Pay Stub? Meaning and Examples Explained

Learn about KMTCHTR on your pay stub, its role in retirement savings, and how to maximize employer matching contributions for a secure financial future.

December 17, 2024

What to Do With Multiple W-2 Forms From the Same or Different Employers?

How to handle multiple W-2 forms from different or same employers. Find expert tips on filing accurate taxes.

December 17, 2024

What Does FWT Mean on Paystub?

Discover the meaning of FWT (Federal Withholding Tax) on pay stub. Understand its implications for your taxes and financial planning with our comprehensive guide.

December 14, 2024

What Are Fringe Benefits?

While some fringe benefits may be required by law, others are offered as a way to attract and retain top talent.

December 10, 2024

Paid in Arrears: What Does It Mean?

Learn about payment in arrears and its significance in payroll. Explore differences from Paid in Advance

January 12, 2025

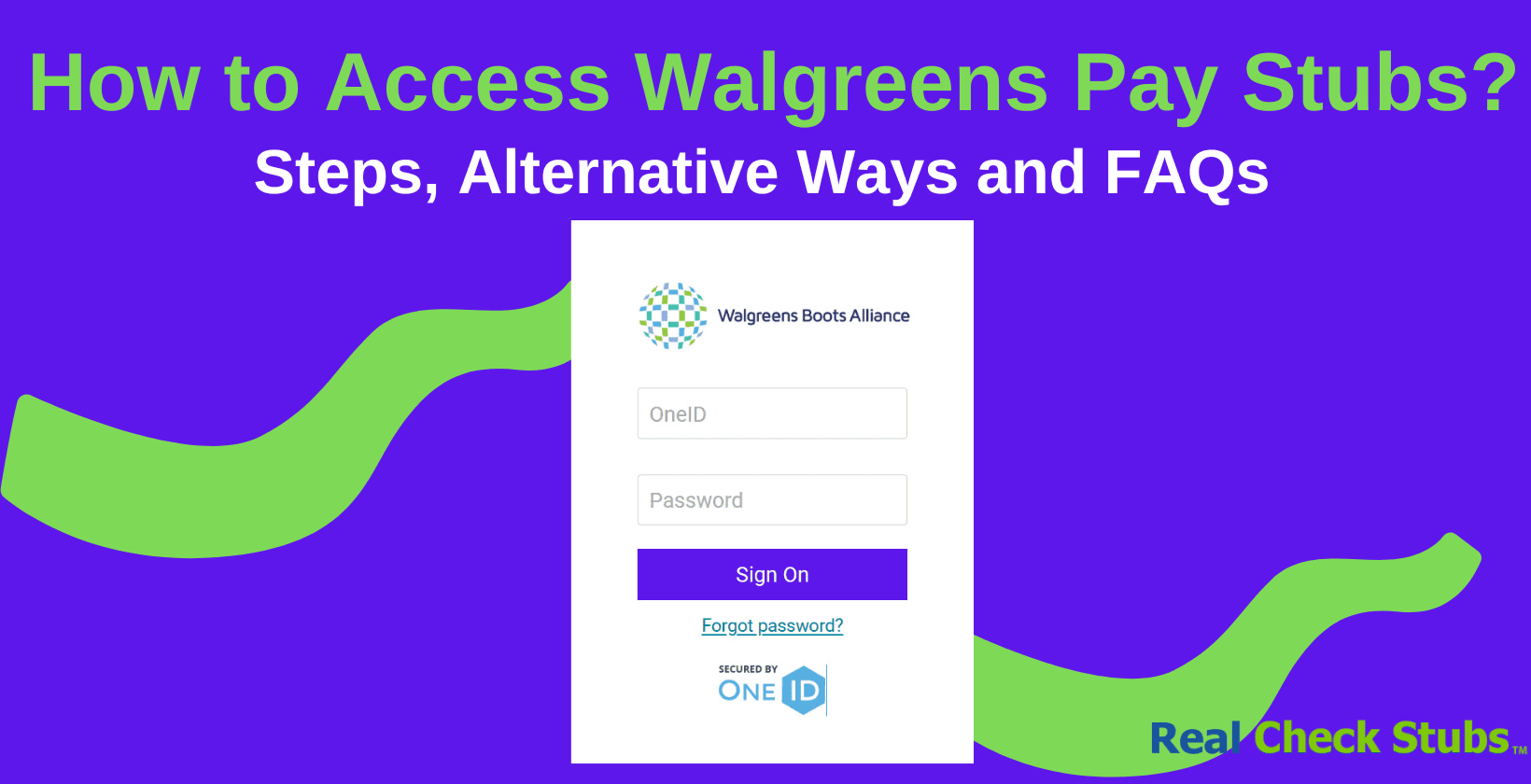

How to Access Walgreens Pay Stubs?

In this guide, we'll share some ways to get your Walgreens paystub. Plus, we cover the possible hurdles you may come across and how to deal with them.

November 28, 2024

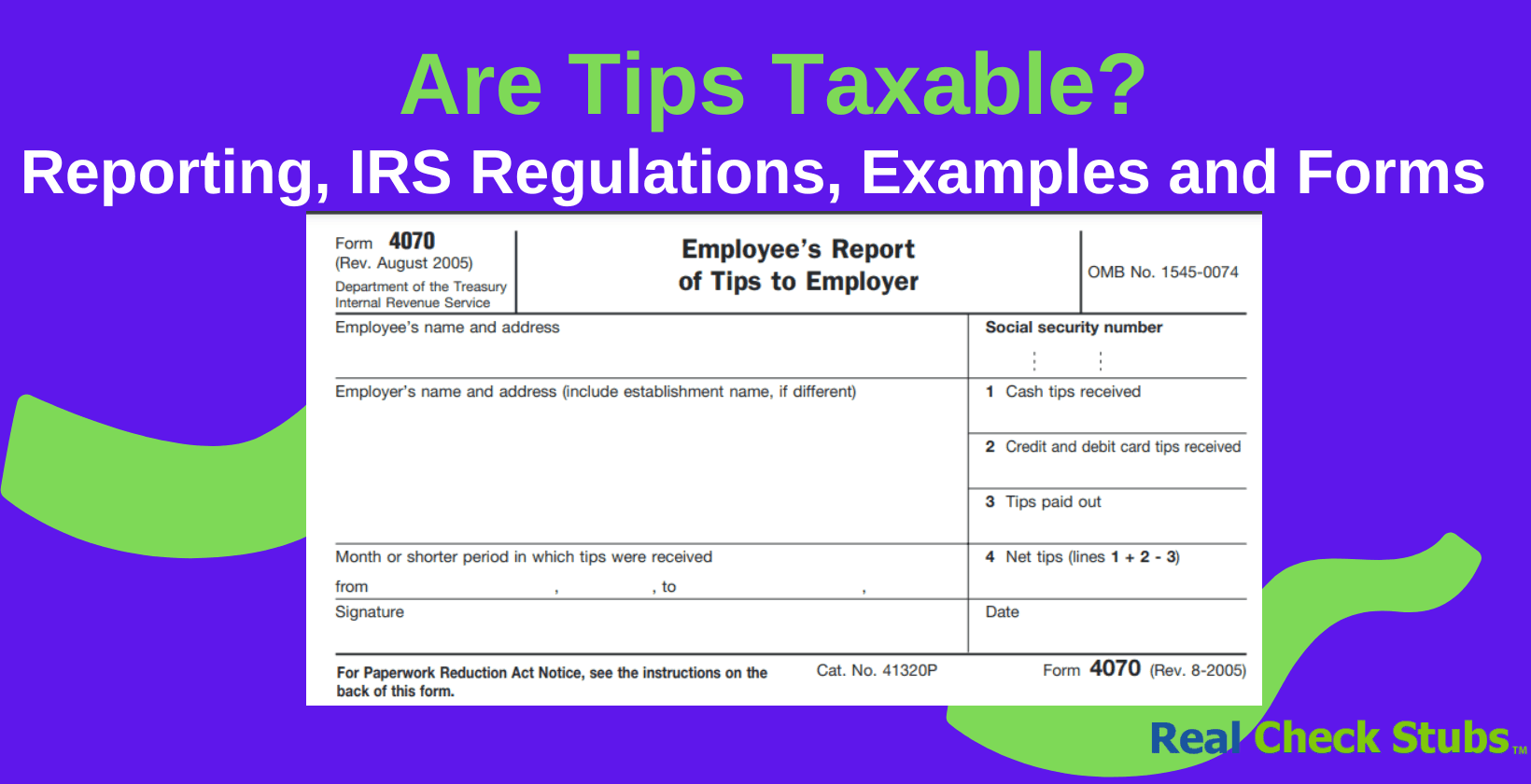

How Are Tips Taxed on Paychecks? Reporting, Compliance, Examples and Forms

According to the Internal Revenue Service (IRS), all cash and non-cash tips received by an employee must be reported to their employer if they total more than $20 in a calendar month.

November 27, 2024

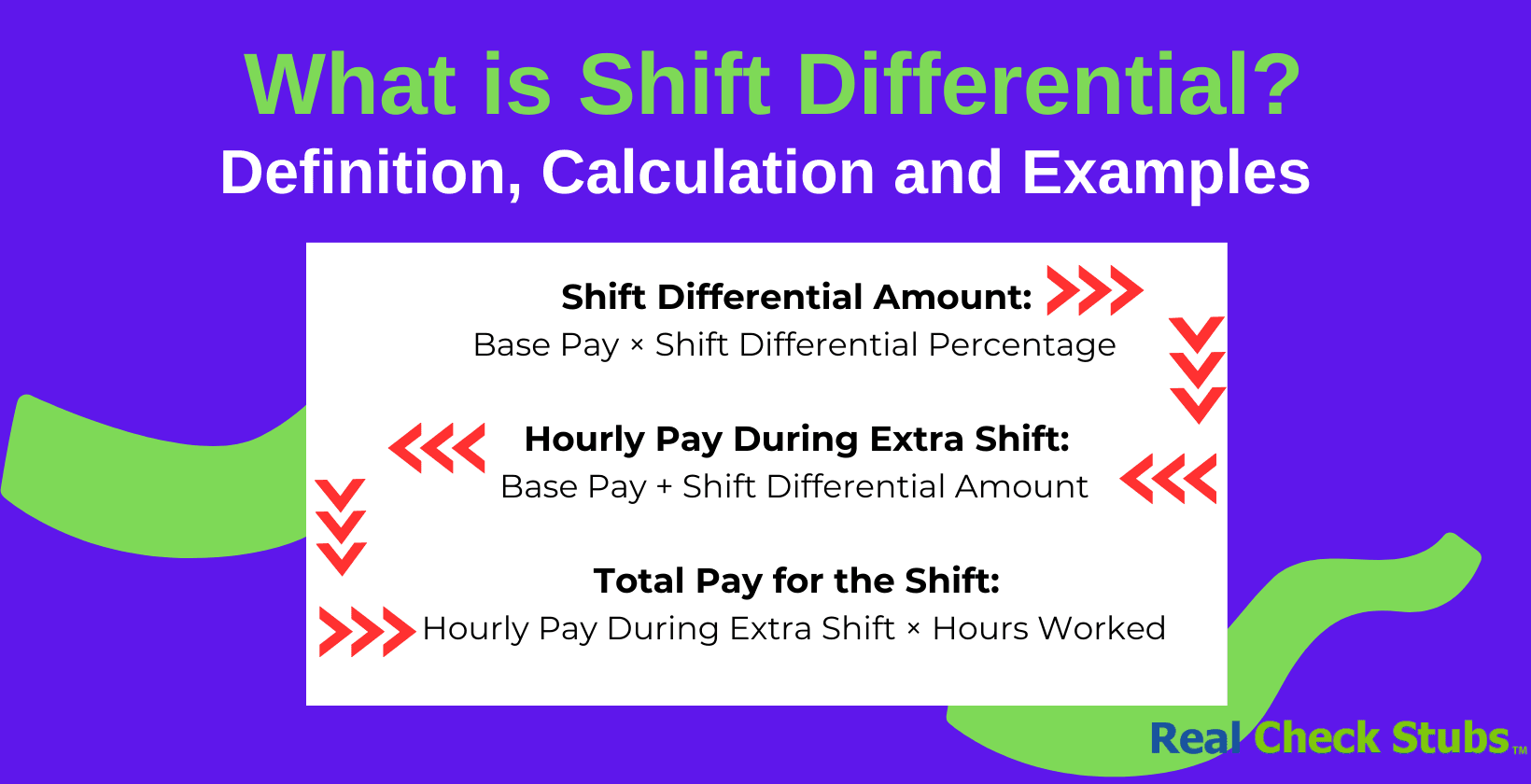

Understanding Shift Differential Pay: What It Means and How It Works

Learn everything about shift differential pay, including its definition, calculations, industry examples, legal considerations, and how it impacts your paycheck. A must-read guide for employees and employers

November 26, 2024

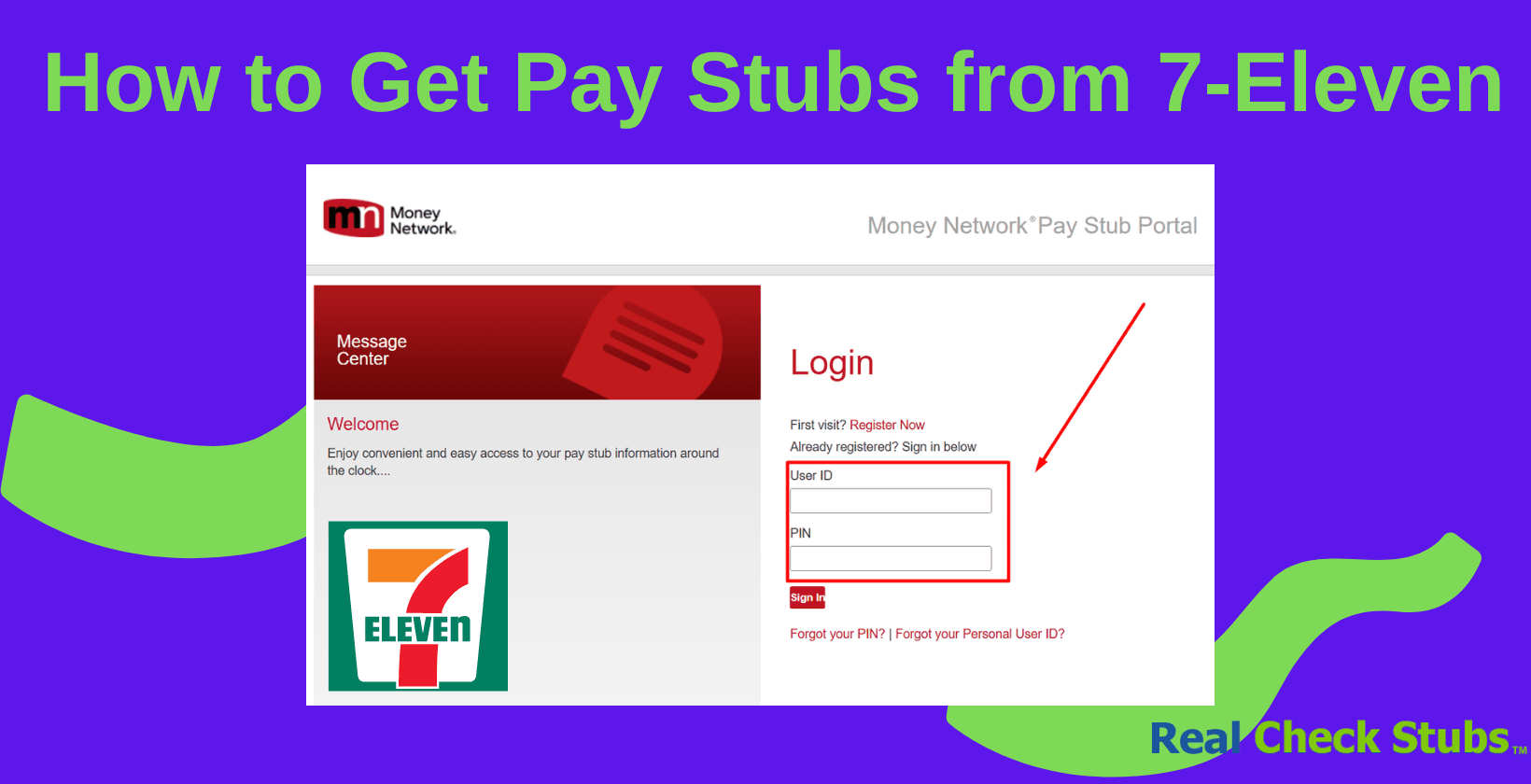

How to Access Pay Stubs and Employee Resources at 7-Eleven

For 7-Eleven employees, accessing payroll, check stub and HR information is made simple through the Paystub Portal and related tools.

June 28, 2024

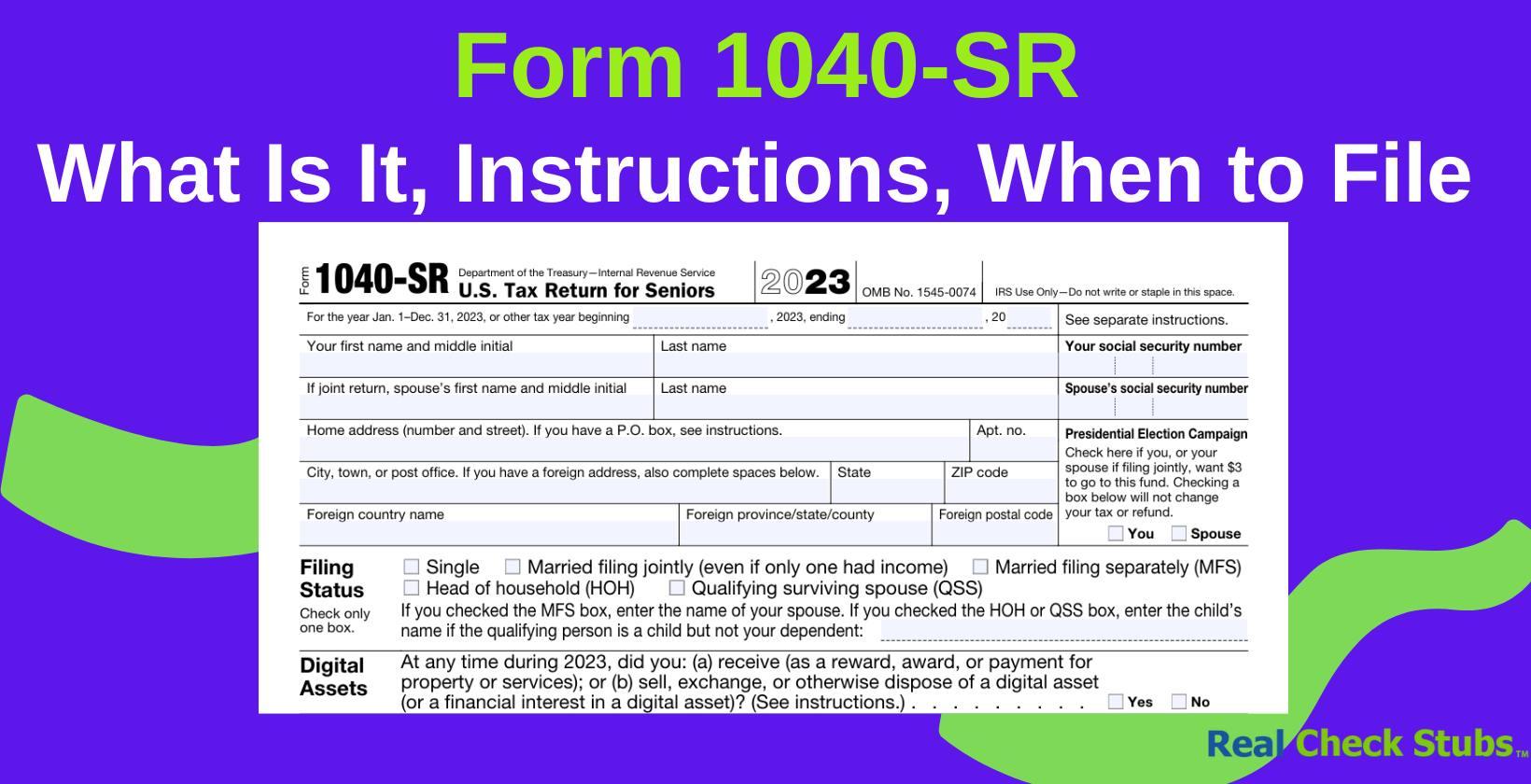

Form 1040-SR: Purpose, Instructions, Filling Out

filing deadlines to where to find the form 1040-SR and how to fill it out,

June 25, 2024

Ohio Paycheck Calculator

The Ohio paycheck calculator makes it much simpler to determine your take home salary after all adjustments.

June 24, 2024

New Jersey Paycheck Calculator

While living in the state of New Jersey, to check your take-home salary you can use this article.

November 23, 2024

Form 940: Purpose, Instructions and Filling Out

Need help with Form 940? Learn how to fill out your FUTA tax return, understand who must file, and when to pay. Get expert guidance now!

June 14, 2024

Georgia Paycheck Calculator

Estimate your Georgia take-home pay after taxes! Use our Georgia paycheck calculator to calculate your net income, including federal, state, and FICA taxes. pen_spark tune share more_vert