How to Calculate Social Security Wages From Pay Stub?

One necessary tax that affects both the company and the employee is the social security tax. In this article, we will discuss how to calculate social security wages from a pay stub.

What Are Social Security Wages?

Social security wages are an employee's earnings from which social security taxes are withheld at the federal level. Pay supplied to hourly and salaried employees must include social security and Medicare taxes that must be withheld by the employer. Federal insurance contribution act taxes, or FICA taxes, refer to both types of taxes.

Who Should Pay Social Security Wages?

The following people should pay social security wages:

- Employers

- Self-employed people

- Employees

Employees and employers get a pay stub as a record of wages and tax contributions or deductions.

Employers and employees pay 6.2 percent of salaries up to a taxable earning of $160,200 (as of 2023), whereas self-employed people pay 12.4 percent.

How to Calculate Social Security Wages

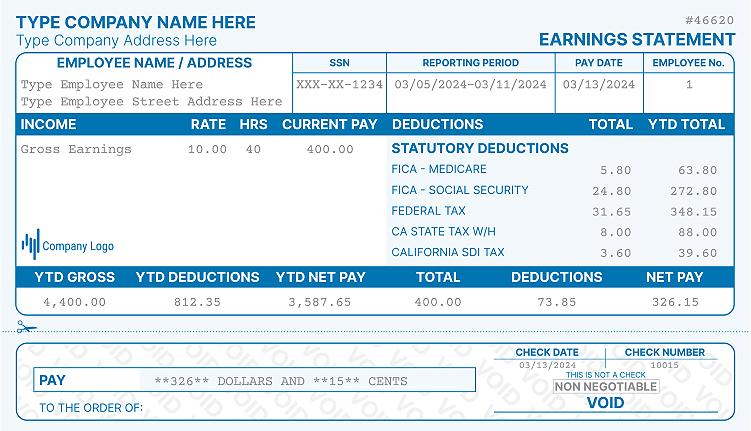

First, compute gross income by adding tips, wages, and taxed distributions. Then, to calculate AGI from Pay Stub, subtract additional payments, contributions, and costs from gross income. Then you will calculate the amount withheld by multiplying the percentage of salary/income kept by social security by AGI.

However, there are some exclusions, which we have mentioned below.

Example Calculation

During her most recent pay period, Margaret earned $3,000 in hourly compensation and $700 in commission, for a total of $2,500 in gross wages. She also had a very enthusiastic client who gave her a tip of $20, which you will exclude from her social security earnings.

Here's how you'd figure out her social security benefits:

($3000 + $700 + $20) - $20 = $3700

When computing how much employee and employer social security tax to withhold from Margaret, the wage amount is $3700.

As an example:

($3700 x 6.2%) x 2 = $459

The reason for multiplication is that we considered both the employee's and employer’s contributions. So, $459 will be deducted from Margaret's salary for social security taxes.

What Is Not Included in Social Security Earnings?

Earnings that do not get included in social security earnings include:

- Premiums for health or accident insurance paid by the employer

- Excess fringe benefits are not taxable

- Contributions by employers to eligible retirement plans

- Benefits from workers' compensation

- If your tips total less than $20 each month

- Underaged family employees

- Wages for some disabled workers

- Business travel expenditures reimbursed

- Employer contributions to health savings accounts (HSAs)

- Statutory payments to non-employees

Mistakes to Avoid When Calculating Social Security Wages

- Do not subtract tips or other expenses that are not a part of the social security tax

- Do consider both the employer and the employee's contribution to the tax. You should multiply the factor by 2 to deduct the sum of both parties.

- You should consider factors such as certain taxpayer groups liberated from collecting social security taxes. Each pay period, the employer is responsible for withholding and remitting the right amount of social security tax to the government.

FAQs

-

Are social security wages the same as gross income?

Social security wages and gross income are not the same thing. While the sum of social security pay and gross income are often the same, we should not consider both terms identical. Also, gross income is the sum of all remuneration from which payroll taxes and other tax withholding gets deducted. Gross income, with certain exceptions, is used to calculate social security wages.

-

Are tips included in social security wages?

Social security wages do not include tips. Although, you will consider tips exceeding $20 per month.

Some notable deviations from this rule exist. The following tips get considered in social security wages:

- Customers' cash tips

- Customers' electronic tips. It includes credit or debit card payments.

- All tips received as a result of tip-sharing arrangements

- The worth of non-cash tips. It may include tickets or any other gift.

-

What is social security wages on W2?

Understanding W2 wages takes time and effort. Box 2 on W2 presents social security wages. Each year, there is a social security pay base, and if you reach that amount, you will no longer be able to deduct social security taxes. Medical, dental, and vision insurance premiums, parking fees, and flex spending all reduce social security income but not retirement savings.

-

How to calculate box 1 on W2 from pay stub?

When employees get their paychecks, the pay stub details their pay for each pay period.

Box 1 on W2 includes tips, wages, or other compensation. This box presents the federal taxable income for the payments included in the calendar year.

To calculate tax from box 1, you need to figure this as YTD earnings minus the pre-tax benefit deductions on a pay stub and pre-tax retirements plus the taxable benefits.

Mathematically, we can write it as

YTD earnings - (pre-tax benefits deduction and pre-tax retirements) + the taxable benefits

Kristen Larson is a payroll specialist with over 10 years of experience in the field. She received her Bachelor's degree in Business Administration from the University of Minnesota. Kristen has dedicated her career to helping organizations effectively manage their payroll processes with Real Check Stubs.